Investors looking to achieve exposure to specific sectors of the U.S. economy often turn to S&P 500 sector ETFs. These funds provide a efficient way to invest in a particular industry, such as technology, healthcare, or energy. Understanding the performance of these ETFs is vital for investors seeking to construct well-diversified portfolios that align with their investment goals.

Historical market conditions have had a substantial impact on the performance of S&P 500 sector ETFs. Specifically, the technology sector has experienced strong growth, while sectors like energy and materials have faced headwinds.

- Drivers influencing sector ETF performance encompass economic indicators, interest rate changes, policy developments, and firm news.

- It's important for investors to conduct their own investigation before committing capital to S&P 500 sector ETFs.

Unlocking Potential with Top-Performing S&P 500 Sector ETFs

Gain exposure to the dynamic US stock market by allocating capital in top-performing S&P 500 sector ETFs. These funds provide a targeted way to become involved in specific market segments. By tailoring your portfolio, you can maximize your gains.

High-growth sector ETFs offer a adaptable method to benefiting from market trends. Whether you're focused on income, there's an S&P 500 sector ETF designed to your aspirations.

- Discover the potential within booming sectors such as healthcare

- Proven sector ETFs can mitigate portfolio risk by providing exposure to various industries

Analyzing top-performing S&P 500 sector ETFs can empower informed investment decisions.

Capitalizing in Sector ETFs for Targeted Growth and Diversification

Sector Exchange Traded Funds (ETFs) present a compelling avenue to investors aiming both targeted growth coupled with diversification within their portfolios. By zeroing in on specific industries, such as technology, healthcare, or energy, investors can amplify their exposure amongst sectors exhibiting strong potential. Additionally, ETFs offer a cost-effective way through achieve diversification, as they typically comprise a basket of securities within a particular sector. This strategy helps to mitigate risk by spreading investments across multiple companies, thus creating a more robust portfolio.

Ultimately, investing in sector ETFs presents a valuable tool for investors wanting to tailor their portfolios in accordance with their specific capital allocation goals. Nonetheless, it's crucial for conduct thorough research and understand the risks and rewards associated from each sector before putting any investment decisions.

Exploring the Landscape of S&P 500 Sector ETFs

The broad market is composed a diverse range of sectors, each with its own characteristics. For capital allocators seeking to hone in on their exposure within this expansive arena, S&P 500 sector ETFs offer a flexible strategy. These instruments track the movements of specific sectors, allowing investors to correspond their portfolios with specific {investment{ goals.

- A number of popular S&P 500 sector ETFs feature those focused on {technology, healthcare, financials, and energy.{

- Individuals should carefully evaluate their risk tolerance when choosing sector ETFs.

- Portfolio construction remains a crucial element of investing, even within sector-specific portfolios.

Leading S&P 500 Sector ETFs to Power Your Portfolio

Navigating the dynamic world of investing can be complex, but sector-specific ETFs provide a targeted approach. By focusing on distinct segments within the S&P 500, you can tailor your portfolio to align with your investment objectives. Here are some of the {mostpromising sector ETFs to consider:

- Technology ETFs offer exposure to innovation within the tech industry.

- Pharmaceuticals ETFs provide returns through companies in the healthcare sector.

- Banking ETFs allow you to participate in the financial services landscape.

When choosing sector ETFs, it's crucial to research each fund's track record, expense ratios, and investment strategy. Remember that diversification is key, so consider a mix of sectors to manage risk and potentially enhance your portfolio's website overall performance.

Strategic Allocation: Choosing the Right S&P 500 Sector ETFs

Navigating the vast landscape of options can be a daunting task for even seasoned financials. A key strategy for success is strategic allocation, which involves spreading your capital across various asset classes to manage risk and optimize potential returns. Within the context of a well-diversified portfolio, focus should be given to distributing assets across industries represented by the S&P 500 index.

- Researching each sector's performance can provide valuable data for informed allocation decisions.

- Assess your risk tolerance when selecting the appropriate weighting for each sector ETF.

- Reallign your portfolio regularly to maintain your desired asset allocation.

By effectively allocating your assets across different S&P 500 sector ETFs, you can construct a well-balanced portfolio that has the ability to meet your long-term goals.

Ralph Macchio Then & Now!

Ralph Macchio Then & Now! Mason Gamble Then & Now!

Mason Gamble Then & Now! Michael J. Fox Then & Now!

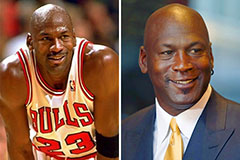

Michael J. Fox Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Barry Watson Then & Now!

Barry Watson Then & Now!